license: apache-2.0

task_categories:

- graph-ml

tags:

- horology

size_categories:

- 100K<n<1M

Watch Market Analysis Graph Neural Network Dataset

Executive Summary

This dataset transforms traditional watch market data into a Graph Neural Network (GNN) structure, specifically designed to capture the complex dynamics of the pre-owned luxury watch market. It addresses three key market characteristics that traditional recommendation systems often miss:

- Condition-Based Value Dynamics: Captures how a watch's condition influences its market position and value relative to other timepieces

- Temporal Price Behaviors: Models non-linear price patterns where certain watches appreciate while others depreciate

- Inter-Model Relationships: Maps complex value relationships between different models that transcend traditional brand hierarchies

Key Statistics

- Total Watches: 284,491

- Total Brands: 28

- Price Range: $50 - $3.2M

- Year Range: 1559-2024

Primary Use Cases

- Advanced watch recommendation systems

- Market positioning analysis

- Value relationship modeling

- Temporal trend analysis

Dataset Description

Data Structure

The dataset is structured as a PyTorch Geometric Data object with three main components:

- Node features tensor (watch attributes)

- Edge index matrix (watch connections)

- Edge attributes (similarity weights)

Features

Key features include:

- Brand Embeddings: 128-dimensional vectors capturing brand identity and market position

- Material Embeddings: 64-dimensional vectors for material types and values

- Movement Embeddings: 64-dimensional vectors representing technical hierarchies

- Temporal Features: 32-dimensional cyclical embeddings for year and seasonal patterns

- Condition Scores: Standardized scale (0.5-1.0) based on watch condition

- Price Features: Log-transformed and normalized across market segments

- Physical Attributes: Standardized measurements in millimeters

Network Properties

- Node Connections: 3-5 edges per watch

- Similarity Threshold: 70% minimum similarity for edge creation

- Edge Weights: Based on multiple similarity factors:

- Price (50% influence)

- Brand similarity

- Material type

- Temporal proximity

- Condition score

Processing Parameters

- Batch Size: 50 watches per chunk

- Processing Window: 1000 watches

- Edge Generation Batch: 32 watches

- Network Architecture: Combined GCN and GAT layers with 4 attention heads

Exploratory Data Analysis

Brand Distribution

The treemap visualization provides a hierarchical view of market presence:

- Rolex dominates with the highest representation, reflecting its market leadership

- Omega and Seiko follow as major players, indicating a strong market presence

- Distribution reveals clear tiers in the luxury watch market

- Brand representation correlates with market positioning and availability

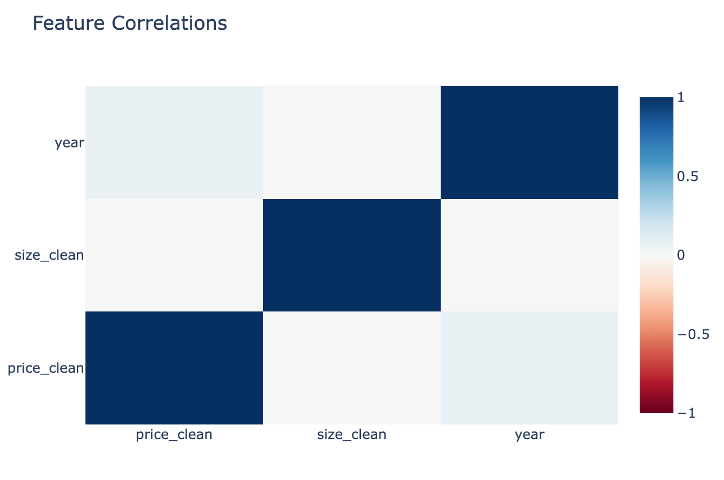

Feature Correlations

The correlation matrix reveals important market dynamics:

- Size vs. Year: Positive correlation indicating a trend toward larger case sizes in modern watches

- Price vs. Size: Moderate correlation showing larger watches generally command higher prices

- Price vs. Year: Notably low correlation, demonstrating that vintage watches maintain value

- Each feature contributes unique information, validated by the lack of strong correlations across all variables

Market Structure Visualizations

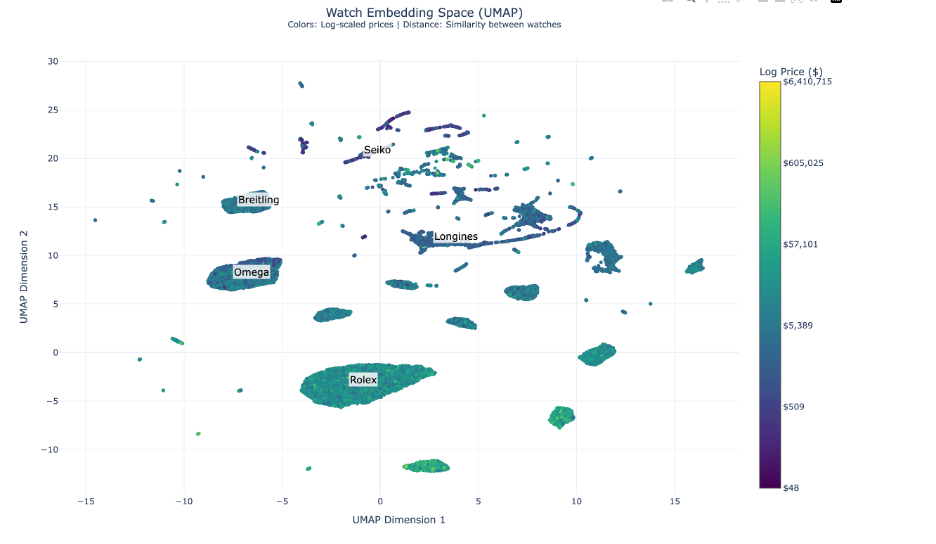

UMAP Analysis

The UMAP visualization unveils complex market positioning dynamics:

- Rolex maintains a dominant central position around coordinates (0, -5), showing unparalleled brand cohesion

- Omega and Breitling cluster in the left segment, indicating strategic market alignment

- Seiko and Longines occupy the upper-right quadrant, reflecting distinct value propositions

- Premium timepieces (yellower/greener hues) show tighter clustering, suggesting standardized luxury attributes

- Smaller, specialized clusters indicate distinct horological collections and style categories

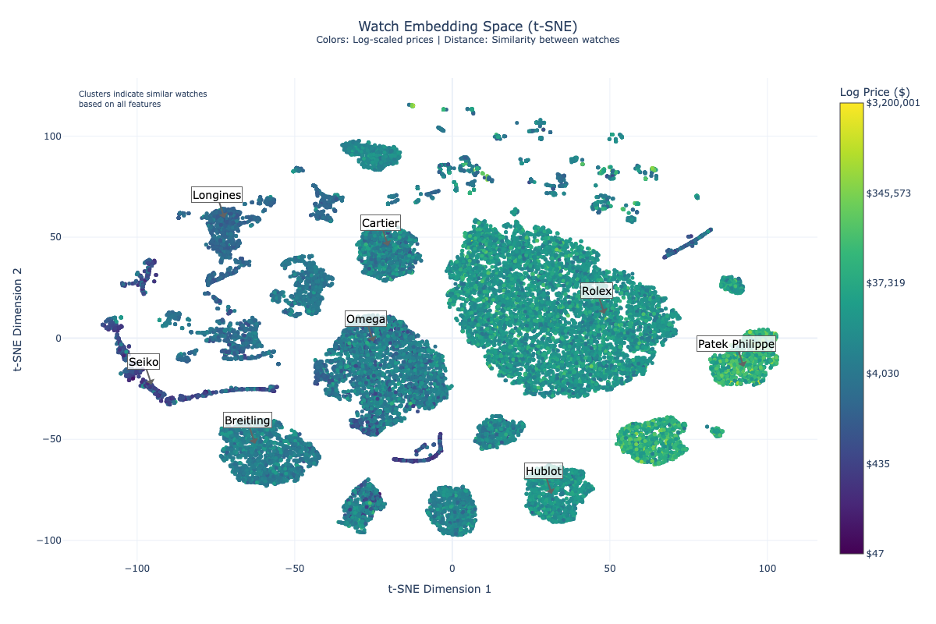

t-SNE Visualization

T-SNE analysis reveals clear market stratification with logarithmic pricing from $50 to $3.2M:

- Entry-Level Segment ($50-$4,000)

- Anchored by Seiko in the left segment

- High volume, accessible luxury positioning

- Mid-Range Segment ($4,000-$35,000)

- Occupies central space

- Shows competitive positioning between brands

- Cartier demonstrates strategic positioning between luxury and mid-range

- Ultra-Luxury Segment ($35,000-$3.2M)

- Dominated by Patek Philippe and Audemars Piguet

- Clear separation in the right segment

- Strong brand clustering indicating market alignment

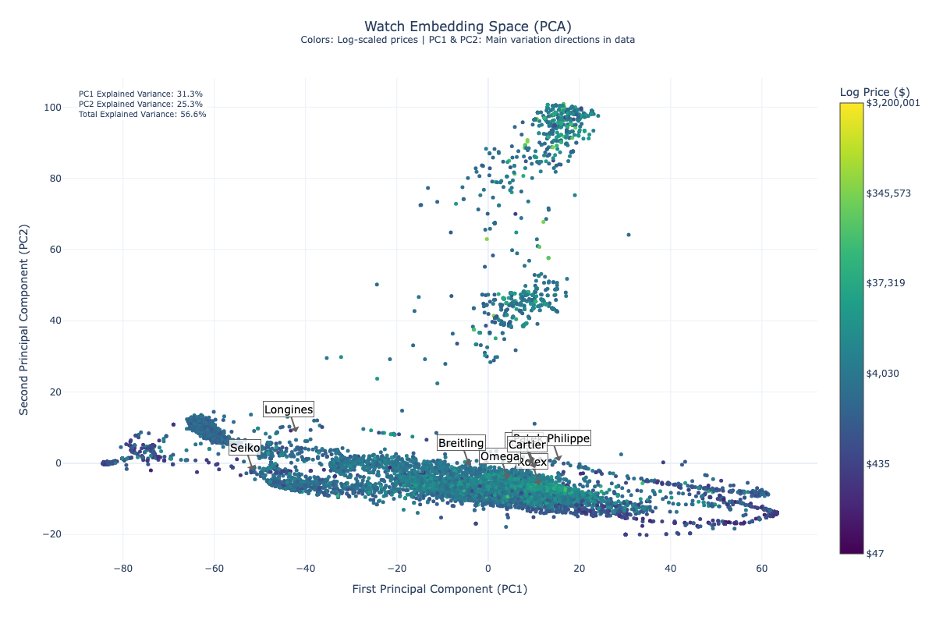

PCA Analysis

Principal Component Analysis provides robust market insights with 56.6% total explained variance:

- First Principal Component (31.3%)

- Predominantly captures price dynamics

- Shows clear separation between market segments

- Second Principal Component (25.3%)

- Reflects brand positioning and design philosophies

- Reveals vertical dispersion indicating intra-brand diversity

- Brand Trajectory

- Natural progression from Seiko through Longines, Breitling, and Omega

- Culminates in Rolex and Patek Philippe

- Diagonal trend line serves as a market positioning indicator

- Market Implications

- Successful brands occupy optimal positions along both dimensions

- Clear differentiation between adjacent competitors

- Evidence of strategic market positioning

Network Visualizations

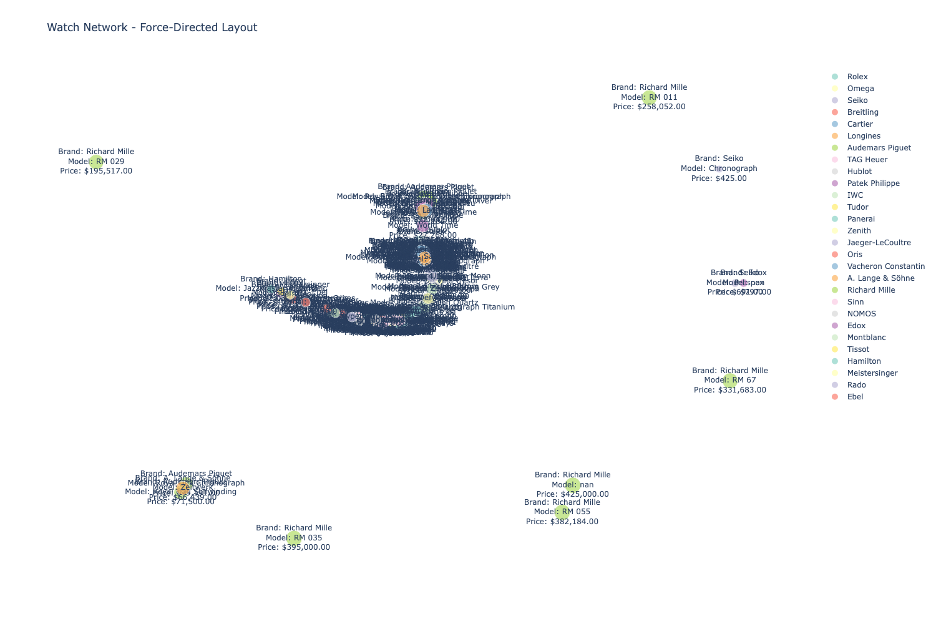

Force-Directed Graph

The force-directed layout reveals natural market clustering:

- Richard Mille's peripheral positioning highlights ultra-luxury strategy

- Dense central clustering shows mainstream luxury brand interconnectivity

- Edge patterns reveal shared market characteristics

- Node proximity indicates competitive positioning

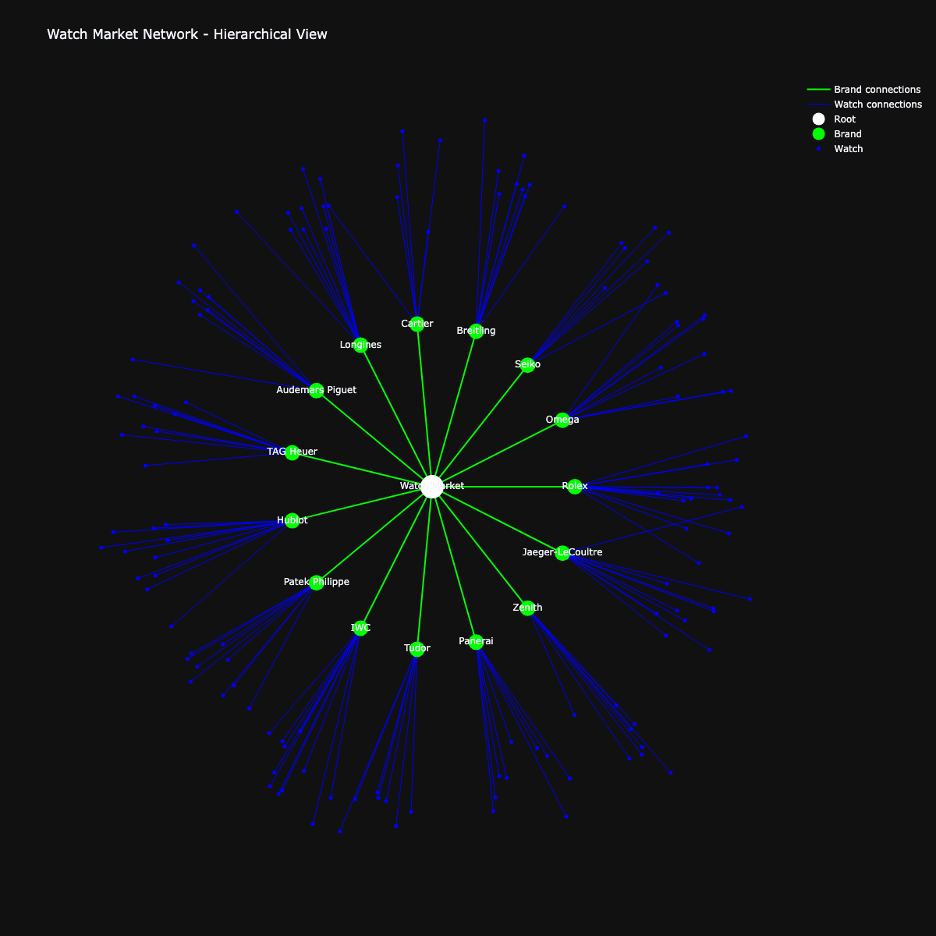

Starburst Visualization

Radial architecture provides a hierarchical market perspective:

- Central node represents the overall market

- Green nodes show brand territories with strategic spacing

- Blue peripheral nodes indicate individual timepieces

- Node density reveals:

- Brand portfolio breadth

- Market penetration depth

- Segment diversification

- Balanced spacing between brand nodes indicates market segmentation

Ethics and Limitations

Data Collection and Privacy

- Dataset consists of publicly available watch listings

- No personal information, seller details, or private transaction data

- Serial numbers and identifying marks removed

- Strict privacy standards maintained throughout collection

Known Biases

Connection Strength Bias

- Edge weights and connections based on author's domain expertise

- Similarity thresholds (70%) chosen based on personal market understanding

- Brand value weightings reflect author's market analysis

- Connection strengths may not universally reflect all market perspectives

Market Representation Bias

- Predominantly represents online listings

- May not fully capture private sales and in-person transactions

- Popular brands overrepresented (Rolex 25%, Omega 14%)

- Limited editions and rare pieces underrepresented

Temporal Bias

- Stronger representation of recent listings

- Historical data may be underrepresented

- Current market conditions more heavily weighted

- Seasonal variations may affect price patterns

Brand and Model Bias

- Skewed toward mainstream luxury brands

- Limited representation of boutique manufacturers

- Popular models have more data points

- Vintage and discontinued models may lack comprehensive data

Price Bias

- Asking prices may differ from actual transaction values

- Regional price variations not fully captured

- Currency conversion effects on price relationships

- Market fluctuations may not be fully represented

Usage Guidelines

Appropriate Uses

- Market research and analysis

- Academic research

- Watch relationship modeling

- Price trend studies

- Educational purposes

Prohibited Uses

- Price manipulation or market distortion

- Unfair trading practices

- Personal data extraction

- Misleading market analysis

- Anti-competitive practices

License

This dataset is released under the Apache 2.0 License, which allows:

- Commercial use

- Modification

- Distribution

- Private use

While requiring:

- License and copyright notice

- State changes

- Preserve attributions

Technical Details

Power Analysis

Minimum sample requirements based on statistical analysis:

- Basic Network: 10,671 nodes (95% confidence, 3% margin)

- GNN Requirements: 14,400 samples (feature space dimensionality)

- Brand Coverage: 768 watches per brand

- Price Segments: 4,320 watches per segment

Current dataset (284,491 watches) exceeds requirements with:

- 5,000+ samples per major brand

- 50,000+ samples per price segment

- Sufficient network density

Implementation Details

Network Architecture

- 3 GNN layers with residual connections

- 64 hidden channels

- 20% dropout rate

- 4 attention heads

- Learning rate: 0.001

Embedding Dimensions

- Brand: 128

- Material: 64

- Movement: 64

- Temporal: 32

Network Parameters

- Connections per watch: 3-5

- Similarity threshold: 70%

- Batch size: 50 watches

- Processing window: 1000 watches

Condition Scoring

- New: 1.0

- Unworn: 0.95

- Very Good: 0.8

- Good: 0.7

- Fair: 0.5

Usage

Required Files

The dataset consists of three main files:

watch_gnn_data.pt(315 MB): Main PyTorch Geometric data objectedges.npz(20.5 MB): Edge informationfeatures.npy(596 MB): Node features

Loading the Dataset

import torch

from torch_geometric.data import Data

# Load the main dataset

data = torch.load('watch_gnn_data.pt')

Access components

node_features = data.x # Shape: [284491, combined_embedding_dim]

edge_index = data.edge_index # Shape: [2, num_edges]

edge_attr = data.edge_attr # Shape: [num_edges, 1]

For direct feature access

features = np.load('features.npy')

Get number of nodes

num_nodes = data.num_nodes

Get number of edges

num_edges = data.num_edges

Find similar watches (k-nearest neighbors)

def find_similar_watches(watch_id, k=5):

# Get watch features

watch_features = data.x[watch_id]

# Calculate similarities

similarities = torch.cosine_similarity(

watch_features.unsqueeze(0),

data.x,

dim=1

)

# Get top k similar watches

_, indices = similarities.topk(k+1) # +1 to exclude self

return indices[1:] # Exclude self

# Get watch features

def get_watch_features(watch_id):

return data.x[watch_id]

Note

- The dataset is optimized for PyTorch Geometric operations

- Recommended to use GPU for large-scale operations

- Consider batch processing for memory efficiency