|

--- |

|

license: apache-2.0 |

|

task_categories: |

|

- graph-ml |

|

tags: |

|

- horology |

|

size_categories: |

|

- 100K<n<1M |

|

--- |

|

|

|

# Watch Market Analysis Graph Neural Network Dataset |

|

|

|

## Executive Summary |

|

|

|

This dataset transforms traditional watch market data into a Graph Neural Network (GNN) structure, specifically designed to capture the complex dynamics of the pre-owned luxury watch market. |

|

It addresses three key market characteristics that traditional recommendation systems often miss: |

|

|

|

- **Condition-Based Value Dynamics**: Captures how a watch's condition influences its market position and value relative to other timepieces |

|

- **Temporal Price Behaviors**: Models non-linear price patterns where certain watches appreciate while others depreciate |

|

- **Inter-Model Relationships**: Maps complex value relationships between different models that transcend traditional brand hierarchies |

|

|

|

### Key Statistics |

|

- Total Watches: 284,491 |

|

- Total Brands: 28 |

|

- Price Range: $50 - $3.2M |

|

- Year Range: 1559-2024 |

|

|

|

### Primary Use Cases |

|

- Advanced watch recommendation systems |

|

- Market positioning analysis |

|

- Value relationship modeling |

|

- Temporal trend analysis |

|

|

|

## Dataset Description |

|

|

|

### Data Structure |

|

The dataset is structured as a PyTorch Geometric Data object with three main components: |

|

- Node features tensor (watch attributes) |

|

- Edge index matrix (watch connections) |

|

- Edge attributes (similarity weights) |

|

|

|

### Features |

|

Key features include: |

|

- **Brand Embeddings**: 128-dimensional vectors capturing brand identity and market position |

|

- **Material Embeddings**: 64-dimensional vectors for material types and values |

|

- **Movement Embeddings**: 64-dimensional vectors representing technical hierarchies |

|

- **Temporal Features**: 32-dimensional cyclical embeddings for year and seasonal patterns |

|

- **Condition Scores**: Standardized scale (0.5-1.0) based on watch condition |

|

- **Price Features**: Log-transformed and normalized across market segments |

|

- **Physical Attributes**: Standardized measurements in millimeters |

|

|

|

### Network Properties |

|

- **Node Connections**: 3-5 edges per watch |

|

- **Similarity Threshold**: 70% minimum similarity for edge creation |

|

- **Edge Weights**: Based on multiple similarity factors: |

|

- Price (50% influence) |

|

- Brand similarity |

|

- Material type |

|

- Temporal proximity |

|

- Condition score |

|

|

|

### Processing Parameters |

|

- Batch Size: 50 watches per chunk |

|

- Processing Window: 1000 watches |

|

- Edge Generation Batch: 32 watches |

|

- Network Architecture: Combined GCN and GAT layers with 4 attention heads |

|

|

|

|

|

## Exploratory Data Analysis |

|

|

|

### Brand Distribution |

|

|

|

|

|

|

|

The treemap visualization provides a hierarchical view of market presence: |

|

- Rolex dominates with the highest representation, reflecting its market leadership |

|

- Omega and Seiko follow as major players, indicating a strong market presence |

|

- Distribution reveals clear tiers in the luxury watch market |

|

- Brand representation correlates with market positioning and availability |

|

|

|

|

|

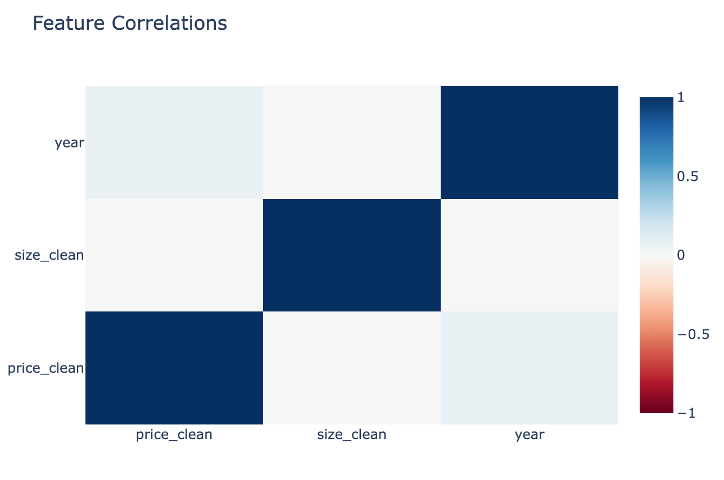

### Feature Correlations |

|

|

|

|

|

|

|

The correlation matrix reveals important market dynamics: |

|

- **Size vs. Year**: Positive correlation indicating a trend toward larger case sizes in modern watches |

|

- **Price vs. Size**: Moderate correlation showing larger watches generally command higher prices |

|

- **Price vs. Year**: Notably low correlation, demonstrating that vintage watches maintain value |

|

- Each feature contributes unique information, validated by the lack of strong correlations across all variables |

|

|

|

|

|

### Market Structure Visualizations |

|

|

|

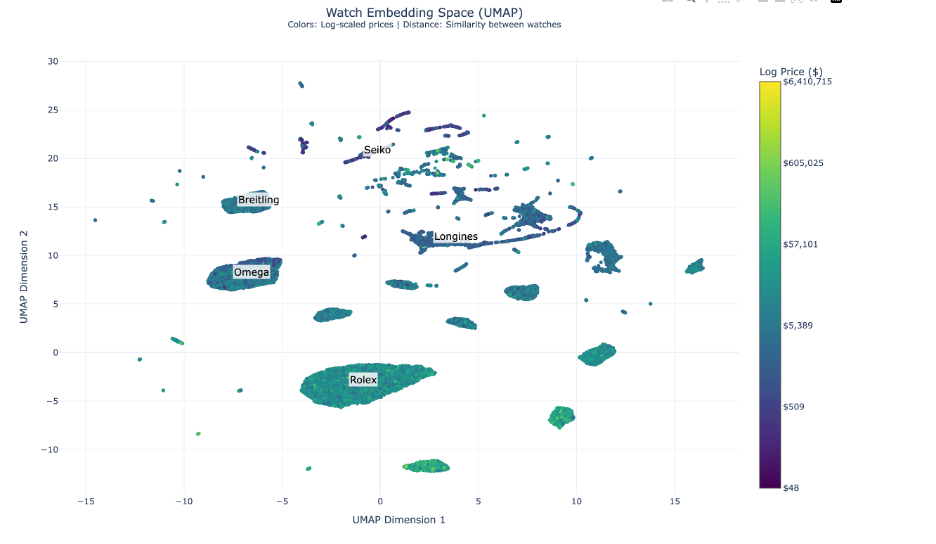

#### UMAP Analysis |

|

|

|

|

|

|

|

The UMAP visualization unveils complex market positioning dynamics: |

|

- Rolex maintains a dominant central position around coordinates (0, -5), showing unparalleled brand cohesion |

|

- Omega and Breitling cluster in the left segment, indicating strategic market alignment |

|

- Seiko and Longines occupy the upper-right quadrant, reflecting distinct value propositions |

|

- Premium timepieces (yellower/greener hues) show tighter clustering, suggesting standardized luxury attributes |

|

- Smaller, specialized clusters indicate distinct horological collections and style categories |

|

|

|

|

|

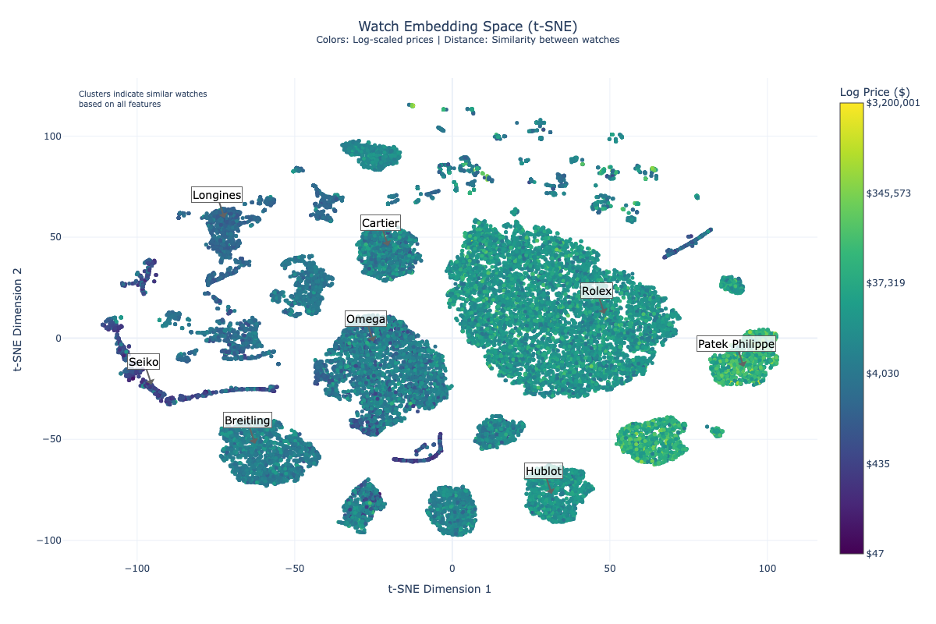

#### t-SNE Visualization |

|

|

|

|

|

|

|

T-SNE analysis reveals clear market stratification with logarithmic pricing from $50 to $3.2M: |

|

- **Entry-Level Segment ($50-$4,000)** |

|

- Anchored by Seiko in the left segment |

|

- High volume, accessible luxury positioning |

|

- **Mid-Range Segment ($4,000-$35,000)** |

|

- Occupies central space |

|

- Shows competitive positioning between brands |

|

- Cartier demonstrates strategic positioning between luxury and mid-range |

|

- **Ultra-Luxury Segment ($35,000-$3.2M)** |

|

- Dominated by Patek Philippe and Audemars Piguet |

|

- Clear separation in the right segment |

|

- Strong brand clustering indicating market alignment |

|

|

|

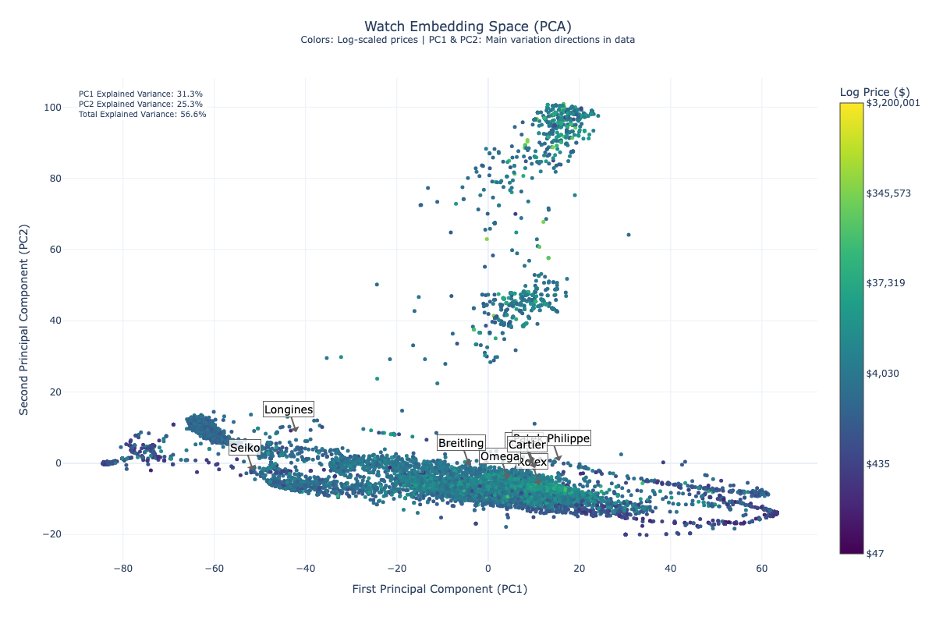

#### PCA Analysis |

|

|

|

|

|

|

|

Principal Component Analysis provides robust market insights with 56.6% total explained variance: |

|

- **First Principal Component (31.3%)** |

|

- Predominantly captures price dynamics |

|

- Shows clear separation between market segments |

|

- **Second Principal Component (25.3%)** |

|

- Reflects brand positioning and design philosophies |

|

- Reveals vertical dispersion indicating intra-brand diversity |

|

- **Brand Trajectory** |

|

- Natural progression from Seiko through Longines, Breitling, and Omega |

|

- Culminates in Rolex and Patek Philippe |

|

- Diagonal trend line serves as a market positioning indicator |

|

- **Market Implications** |

|

- Successful brands occupy optimal positions along both dimensions |

|

- Clear differentiation between adjacent competitors |

|

- Evidence of strategic market positioning |

|

|

|

|

|

#### Network Visualizations |

|

|

|

|

|

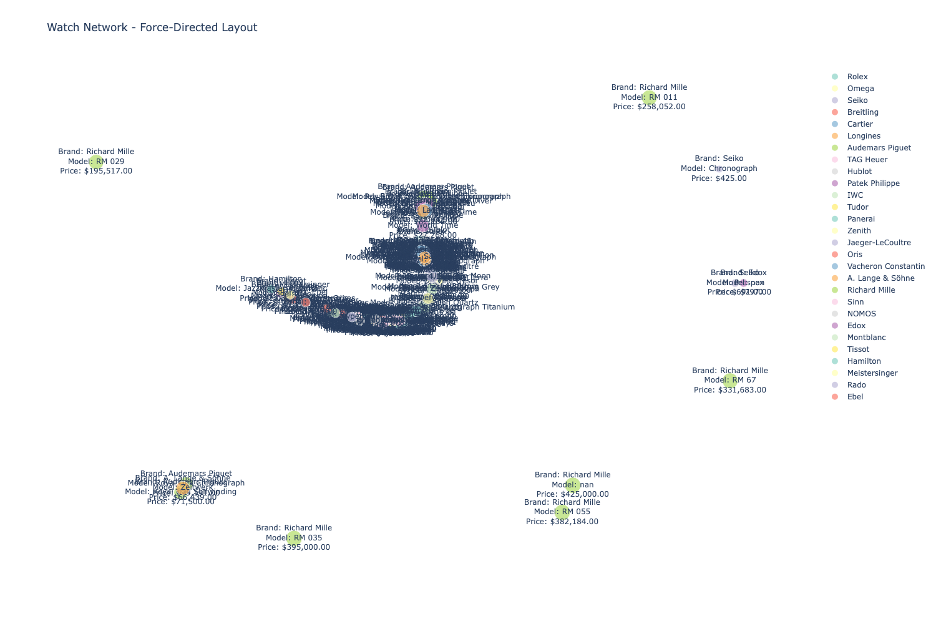

**Force-Directed Graph** |

|

|

|

|

|

|

|

The force-directed layout reveals natural market clustering: |

|

- Richard Mille's peripheral positioning highlights ultra-luxury strategy |

|

- Dense central clustering shows mainstream luxury brand interconnectivity |

|

- Edge patterns reveal shared market characteristics |

|

- Node proximity indicates competitive positioning |

|

|

|

|

|

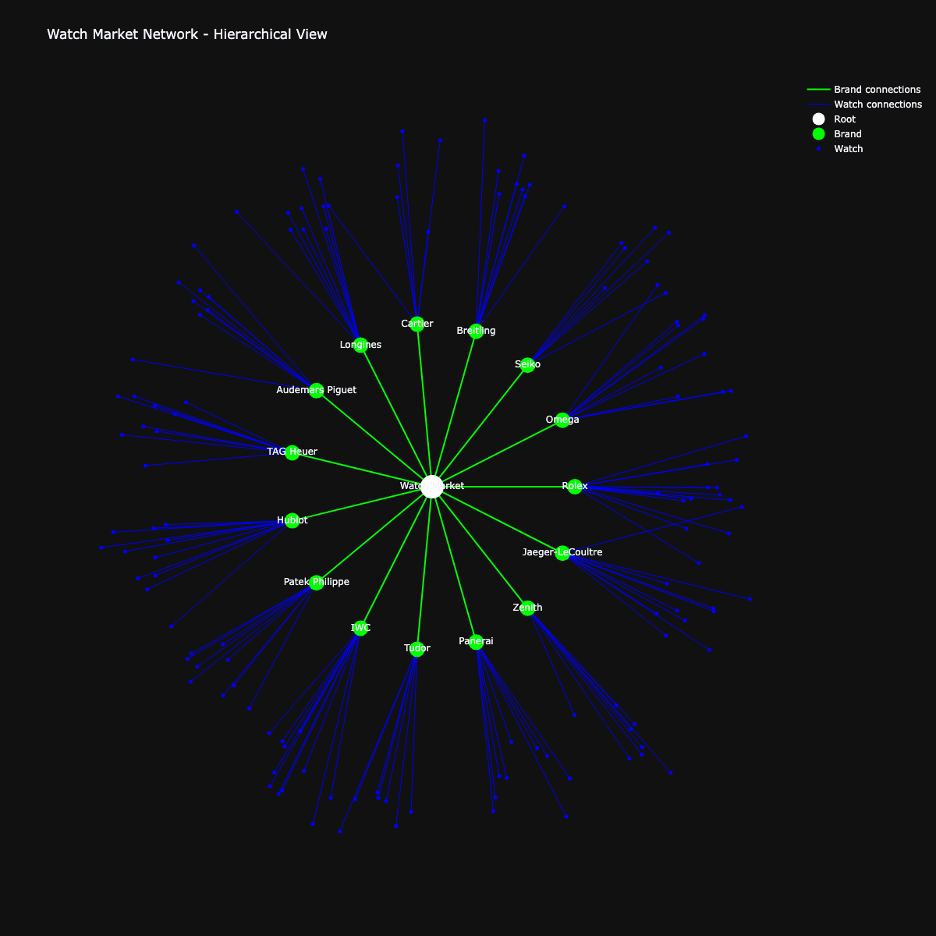

**Starburst Visualization** |

|

|

|

|

|

|

|

Radial architecture provides a hierarchical market perspective: |

|

- Central node represents the overall market |

|

- Green nodes show brand territories with strategic spacing |

|

- Blue peripheral nodes indicate individual timepieces |

|

- Node density reveals: |

|

- Brand portfolio breadth |

|

- Market penetration depth |

|

- Segment diversification |

|

- Balanced spacing between brand nodes indicates market segmentation |

|

|

|

|

|

## Ethics and Limitations |

|

|

|

### Data Collection and Privacy |

|

- Dataset consists of publicly available watch listings |

|

- No personal information, seller details, or private transaction data |

|

- Serial numbers and identifying marks removed |

|

- Strict privacy standards maintained throughout collection |

|

|

|

### Known Biases |

|

|

|

#### Connection Strength Bias |

|

- Edge weights and connections based on author's domain expertise |

|

- Similarity thresholds (70%) chosen based on personal market understanding |

|

- Brand value weightings reflect author's market analysis |

|

- Connection strengths may not universally reflect all market perspectives |

|

|

|

#### Market Representation Bias |

|

- Predominantly represents online listings |

|

- May not fully capture private sales and in-person transactions |

|

- Popular brands overrepresented (Rolex 25%, Omega 14%) |

|

- Limited editions and rare pieces underrepresented |

|

|

|

#### Temporal Bias |

|

- Stronger representation of recent listings |

|

- Historical data may be underrepresented |

|

- Current market conditions more heavily weighted |

|

- Seasonal variations may affect price patterns |

|

|

|

#### Brand and Model Bias |

|

- Skewed toward mainstream luxury brands |

|

- Limited representation of boutique manufacturers |

|

- Popular models have more data points |

|

- Vintage and discontinued models may lack comprehensive data |

|

|

|

#### Price Bias |

|

- Asking prices may differ from actual transaction values |

|

- Regional price variations not fully captured |

|

- Currency conversion effects on price relationships |

|

- Market fluctuations may not be fully represented |

|

|

|

### Usage Guidelines |

|

|

|

#### Appropriate Uses |

|

- Market research and analysis |

|

- Academic research |

|

- Watch relationship modeling |

|

- Price trend studies |

|

- Educational purposes |

|

|

|

#### Prohibited Uses |

|

- Price manipulation or market distortion |

|

- Unfair trading practices |

|

- Personal data extraction |

|

- Misleading market analysis |

|

- Anti-competitive practices |

|

|

|

### License |

|

This dataset is released under the Apache 2.0 License, which allows: |

|

- Commercial use |

|

- Modification |

|

- Distribution |

|

- Private use |

|

|

|

While requiring: |

|

- License and copyright notice |

|

- State changes |

|

- Preserve attributions |

|

|

|

|

|

## Technical Details |

|

|

|

### Power Analysis |

|

Minimum sample requirements based on statistical analysis: |

|

- Basic Network: 10,671 nodes (95% confidence, 3% margin) |

|

- GNN Requirements: 14,400 samples (feature space dimensionality) |

|

- Brand Coverage: 768 watches per brand |

|

- Price Segments: 4,320 watches per segment |

|

|

|

Current dataset (284,491 watches) exceeds requirements with: |

|

- 5,000+ samples per major brand |

|

- 50,000+ samples per price segment |

|

- Sufficient network density |

|

|

|

### Implementation Details |

|

|

|

#### Network Architecture |

|

- 3 GNN layers with residual connections |

|

- 64 hidden channels |

|

- 20% dropout rate |

|

- 4 attention heads |

|

- Learning rate: 0.001 |

|

|

|

#### Embedding Dimensions |

|

- Brand: 128 |

|

- Material: 64 |

|

- Movement: 64 |

|

- Temporal: 32 |

|

|

|

#### Network Parameters |

|

- Connections per watch: 3-5 |

|

- Similarity threshold: 70% |

|

- Batch size: 50 watches |

|

- Processing window: 1000 watches |

|

|

|

#### Condition Scoring |

|

- New: 1.0 |

|

- Unworn: 0.95 |

|

- Very Good: 0.8 |

|

- Good: 0.7 |

|

- Fair: 0.5 |

|

|

|

## Usage |

|

|

|

### Required Files |

|

The dataset consists of three main files: |

|

- `watch_gnn_data.pt` (315 MB): Main PyTorch Geometric data object |

|

- `edges.npz` (20.5 MB): Edge information |

|

- `features.npy` (596 MB): Node features |

|

|

|

### Loading the Dataset |

|

|

|

```python |

|

import torch |

|

from torch_geometric.data import Data |

|

|

|

# Load the main dataset |

|

data = torch.load('watch_gnn_data.pt') |

|

``` |

|

|

|

#### Access components |

|

|

|

``` |

|

node_features = data.x # Shape: [284491, combined_embedding_dim] |

|

edge_index = data.edge_index # Shape: [2, num_edges] |

|

edge_attr = data.edge_attr # Shape: [num_edges, 1] |

|

``` |

|

#### For direct feature access |

|

``` |

|

features = np.load('features.npy') |

|

``` |

|

#### Get number of nodes |

|

``` |

|

num_nodes = data.num_nodes |

|

``` |

|

|

|

#### Get number of edges |

|

``` |

|

num_edges = data.num_edges |

|

``` |

|

|

|

#### Find similar watches (k-nearest neighbors) |

|

``` |

|

def find_similar_watches(watch_id, k=5): |

|

# Get watch features |

|

watch_features = data.x[watch_id] |

|

|

|

# Calculate similarities |

|

similarities = torch.cosine_similarity( |

|

watch_features.unsqueeze(0), |

|

data.x, |

|

dim=1 |

|

) |

|

|

|

# Get top k similar watches |

|

_, indices = similarities.topk(k+1) # +1 to exclude self |

|

return indices[1:] # Exclude self |

|

|

|

# Get watch features |

|

def get_watch_features(watch_id): |

|

return data.x[watch_id] |

|

|

|

``` |

|

|

|

## Note |

|

- The dataset is optimized for PyTorch Geometric operations |

|

- Recommended to use GPU for large-scale operations |

|

- Consider batch processing for memory efficiency |

|

|